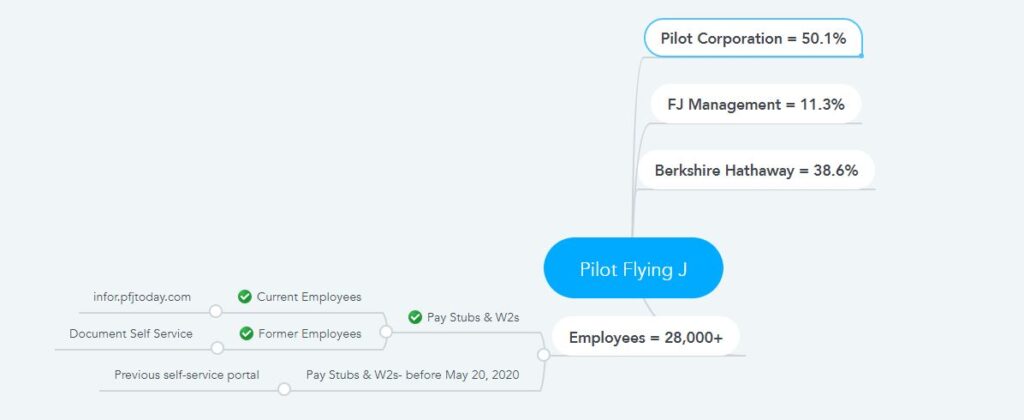

Pilot Flying J is the largest truck stop chain in the United States, headquartered in Knoxville, Tennessee. More than 750 truck stops across the United States, Canada, and North America, with more than 73,000 parking spaces. Pilot Corporation currently owns 50.1 percent of the company, owned by American Petroleum Corporation, FJ Management, and Berkshire Hathaway. The company owns 11.3 percent and 38.6 percent, respectively. Initially, the three companies signed an argument and created Pilot Flying J on July 1, 2010. The company currently has more than 28,000 employees. The company’s current reputation is due to the tireless work of all those employees. Employees are also provided attractive opportunities by the organization. Knoxville, Tennessee, has been the top workplace for the past four years and was even ranked as the number #1 top workplace in the Knoxville business division of Tennessee in 2020. However, this article will discuss how Pilot Flying J’s crew will access their pay stubs and W-2 forms.

- How to access pay-stub and tax forms?

Pilot Flying J distributes pay stubs and tax forms to their former and current employees separately and has been using the new web since July 2020 to spread pay stubs and tax forms to employees. So I will discuss three points on how employees will access their pay stubs and tax forms. How will the current employees access their pay stubs and tax forms? How to access ex-employees, and last but not least, how to access pre-2020 pay stubs and tax forms. Follow the directions to the points set according to your current work situation.

- This guideline applies to current employees-

Employees currently working on Pilot Flying J will access their pay stubs and tax forms from the Inner Self-Service Portal. To access the Infor Self-Service Portal, visit this https://infor.pfjtoday.com/ web address and log in with the user ID and password obtained from the IT office. Because you can only access it after logging in to your pay-stub and tax form, and you have to change your password every ninety days. However, if you have any problem related to your login, you can reset your password or unlock your account by calling this technology number 865 474 4357 of the Technology Solution Center.

However, suppose you want to access Pilot Flying J’s Inferior Self-Service Portal from your personal computer or mobile device. In that case, you must use the two-factor authentication and Citrix receiver applications. Once your login is complete, click on the “Pay” submenu. Then click on “Pay Checks” to view the pay stub view and click on “Year-to-date” to view the tax form.

- This instruction applies to former employees-

If you retire from Pilot Flying J on or after May 20, 2020, you will be able to access your pay stub and tax forms from two portals. Your pay stub and tax form will in no way be accessed from the infer portal designated for current employees. The following sections will discuss how to access pay stubs and tax forms on or before May 20, 2020. However, this section will discuss how to access the pay stubs or W-2 forms on or after May 21, 2020. Former employees will access pay stubs and tax forms from the pilot company’s Document Self-Service from May 21, 2020.

- First, visit the Pilot Company’s Document Self Service Web site, whose web address is https://edocs.pilotcompany.com/Auth/Login/. Then complete the registration and login. Click on the “Register User” link to register, and this link is below the “Login” button. You will require the last three digits of your Social Security number, Employee ID number, and email address to register.

- Once the registration is complete, enter your user ID and password, select “MHC Knowledge-Based Authentication,” and log in.

- After logging in, click on the “Payroll” sub-menu to access your pay stub under the “My Documents” menu. However, suppose you have not set your document delivery settings when completing the registration process. In that case, you can select your pay stubs web delivery or email delivery options by clicking on “My Delivery Settings.”

- In the same way, to access your W-2 form, 1095-C, T4, and Releve, you have to select each separate delivery option.

- To access your W2 form in Web Delivery, click the “W-2” sub-menu under the “My Documents” menu. If you have selected the email delivery option, you will receive your W-2 form via email, password-protected.

- This guideline applies to access to pay stubs and tax forms on and before May 20, 2020

Visit Pilot Flying J’s previous self-service portal to access the pay stubs and tax forms on and before May 20, 2020. Enter your employer number and your name’s first and last part in uppercase letters. Then enter the year of birth and the last four digits of your SSN and click on the “Submit” button. Then you will be able to access the pay stub and tax forms for May 20, 2020, and earlier. The web address of Pilot Flying J’s previous self-service portal is https://www.pilottravelcenters.com/Login/Employee_Login.aspx.

Resources

I need a copy of my last pay stub

I need my w2 can’t get it on line I tried

Me too. I call and they said “I’m putting my social security wrong” I said “How? I know my social security. You can’t deny my information” and they said I can’t do nothing but give u and email or leave a voicemail to someone who can help. And they never called me back or reply my email. But I did call so many times with complaints and only 1 person help and she went and talked to somebody for me and that person send my W2. Sooo no matter what they say they can get in your file and help you out.

Am having issues cashing a check ,I was a current employee there .. and not working there anymore… How can I move forward in fixing my issue

..

I am a former employee and cannot access my W2s

I am a former employee and can’t access my w2’s

I can’t get my w2 either it’s bull

Who pays pilots payroll???

Quick question who pays pilots payroll??

When wil w2 be sent

can i get my w2 on adp

I am a former employee of Flying J in George West, Texas. I am trying to get my W2 form, but I do not remember my employee number. What do I need to do to get the W2? thank you in advance for your help

I can not access my W2, please send me a paper copy to my address on file

I used to work at Pilot J in Carlsbad New Mexico and I am wanting to know if you can mail me my W-2 forms my address is 206 South 5th Street Carlsbad New Mexico 88220 thank you

I need my w2

I worked on pilot and need my form w-2

I’m getting a lawyer. This website does not work. They cannot NOT give me my w2.

I am a past employee and I can’t get my w-2. I don’t have my employee# please help!

I’m having the same problem and my last check

I need my W2

Need w2

Im looking for my last check and my W-2 form. please get back to me.

I don’t have a password for W-2 and need my last check for pilot flying j.

i need my w2 so i can do my taxes please

I’ve been trying since January to get my W2 with no luck. What in the world do I need to do to get my own money?

Can’t get my W2

My name is Sherra Mills and I’m trying to get in contact w/payroll concerning corrections/on my tax form so that I may get my extension sent of today before 5:00p 04/18/2023. I work in Troutman, NC @ the store off of Hwy 21. I need the correct info so I may apply it to my Extension Form (ASAP) please! You may contact me @ smills@iss.k12.nc.us

Okay

I need to get my paycheck for this week

I need my paycheck for this week

I cannot access my T4 for my employment with Flying J which ended fall of 2024. Are they being mailed to address on file?