How to Access Akima Pay Stubs and W2s Online?

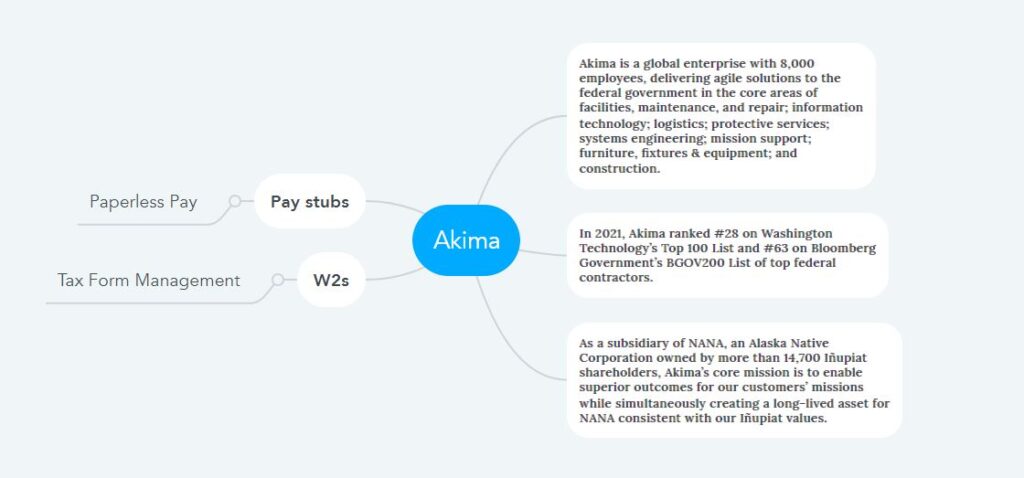

The Northwest Arctic Native Association, more commonly known as NANA but no longer by its acronym, has played a vital role in resolving a land claim by Native peoples in Alaska seeking pipelines from the state and federal governments. A subsidiary of this NANA is Akima, an Alaska Native corporation that is a global enterprise in the Defense and Space Manufacturing industry and explicitly oversees the state-of-the-art operations of the federal government. The highest standards of ethics have always guided Akima to maintain its core mission of achieving superior results for its customers. Another unique and exciting thing is that this company always keeps in mind that the past is the fuel of its future and, therefore, constantly strives to fulfill the promises made to everyone by maintaining integrity with dignity and respect. Also, the company is always aware of the workforce and sometimes brings some updates on their welfare. For example, Akima has started adopting Equifax Inc.’s latest workforce management service to issue pay stubs, and w2s to all employees, which helps the company’s HR department complete all tasks efficiently and simultaneously saves the company time and cost.

Access your pay statements and tax forms online by following the instructions below-

- Equifax has separate systems for issuing Pay Stubs and W2 statements to employees working at any company. Paperless Pay System is for giving pay stubs, and Tax Form Management System is for giving W2 forms. Here, the Paperless Pay system and Tax Form Management system are owned by Equifax, and the login system is the same. That means you can log in to both systems using your same credentials. So I am detailing the login system by mentioning the separate link of both systems.

- Access the Link to Paperless Pay System to Receive Pay Stubs: https://paperlesspay.talx.com.

- Access the Link to Tax Form Management System to Receive the W2 Statement: https://mytaxform.com.

- Akima company employer code for both systems is 19221.

- Now let’s try to log in to any system. And yes, one more thing that is not mentioned is that you don’t have to face any registration process because the authorities have registered you with the information you have provided on file at the time of recruitment in Akima. So after hiring, your employer will provide your login credentials (User ID and PIN) directly, or you will get them via email from the system administrator.

- Now visit the Paperless Pay or Tax Form Management system link and first enter your Employer Code in the “Login” panel. Then after clicking on the “Login>>” button, click on “Click Here to Login >” from the next screen. This time, you will get the actual login panel in a pop-up screen, input your User ID, and click on the “Continue>” button. On the next screen, enter your PIN (Personal Identification Number) and click on the “Login>” button to access the portal.

- However, if this is your first-time login attempt, you must complete some one-time steps before reaching the dashboard, which will never appear on the screen after login. Among the One-Time steps are to change the PIN received from the employer and create a new PIN, set up the security image, answer some security questions, and store it in the system. Then provide your current active phone number and email address to receive your document update notification.

- Now in case of login to the Paperless Pay system, you must complete the enrollment process through the “Enroll Now” option following the instructions on the screen. And in the case of logging into the Tax Form Management system, accept the system’s terms and conditions, give “W2 Consent,” and select “Receive Forms Online” as the W2 delivery option.

- Finally, by accessing the “My Account” menu, you can receive your Pay Stub from the Paperless Pay system dashboard or your W2 Statement from the Tax Form Management system dashboard.

Disclaimer: The Akima and Akima logos are the Akima company’s registered trademarks and copyrighted works.