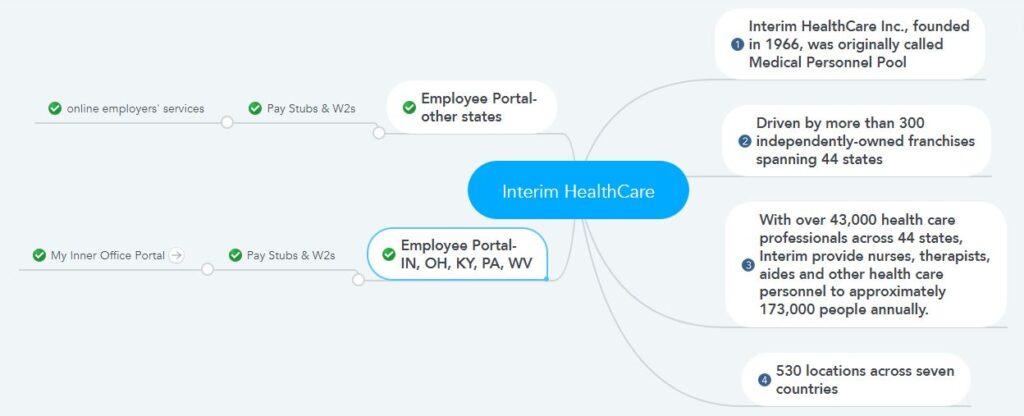

Interim Healthcare is the number #1 national healthcare franchisor. Interim Healthcare has more than 300 franchises across 44 states in the United States. Each franchise is individually owned and operated independently. Apart from the United States, there are about 250 Interim Healthcare franchises in 6 other countries worldwide. The company specializes in providing medical staffing, home health care, senior care, franchise, hospice, elder care, chronic disease management, pediatric care, and therapy services. The company was established in 1966, about 55 years ago. It is currently part of Caring Brands International, a leading in-home medical and non-medical care service international franchisor. Since franchises are individually owned and operated independently, the activities of each franchisee are also individual, and not all services exist in all franchises. The benefits franchisees offer to employees are also unique, but Interim Healthcare’s franchisees in the United States use the same method to distribute pay stubs and W2s forms to their employees. These documents will discuss how Interim Healthcare staff will access their pay stubs and tax forms.

- How will Interim Healthcare employees access their pay stubs and tax forms?

Franchisees in Ohio, Indiana, Kentucky, Pennsylvania, and West Virginia distribute pay stubs and tax forms to employees through an employee self-service portal. On the other hand, franchisees in other states besides the franchises in these five states use online employers’ services. This is discussed in detail below.

- How do employees of Interim Healthcare’s franchises in Ohio, Indiana, Kentucky, Pennsylvania, and the state of West Virginia access pay stubs and tax forms?

Interim Healthcare’s franchise management company has created an employee portal called My Inner Office Portal to distribute pay stubs and tax forms in these five states. The web address of the Employee Self-Service Portal is https://myinterim.interim-health.com/Account/Login. This web portal has a security wall, so every employee must log in with their username and password or complete the registration—the last part of your name, social security number, date of birth, and phone number to register. You will also be required to enter the username and password, select the security question for the account’s security, and then enter the answer. So, enter the necessary information by clicking on the “Register” link to start the registration.

- Employees of other Interim Healthcare franchises will be able to access their pay stubs and tax forms by following the procedure below:

- Visit the online employer’s official website to access tax forms and pay stubs.

- Then click on the “Client Login” link at the top.

- Then click on the “Payroll” link in the “Client and Employee Login” section.

- Then log in by entering your log-in id and password or click on the “Click Here to Create Your Account” link.

- To create your account, enter the last part of your name and the last four digits of your SSN in the First Time User Name field, such as shelton4737.

- Then enter your access code and click on submit button; your access code is 41592242.

- In the next window, you must enter a password of your choice twice, enter an email address, and click the “Save Change” button. And reactivate your account by logging in again with login credentials.

- To secure your account, you need to choose a personal image, a Phrase, and five security questions to answer. Then confirm your email ID by clicking on the link provided in the email.

- If you want to skip the security verification to your personal computer during the next login, mark the “Yes, I plan on using this computer to access online employer in the future” option or select No and click on the “Continue to Online Employer” button.

- Then click on your organization’s name located under the “Information Center” to access your pay stubs and W-2 forms.

Resources

Online Employer