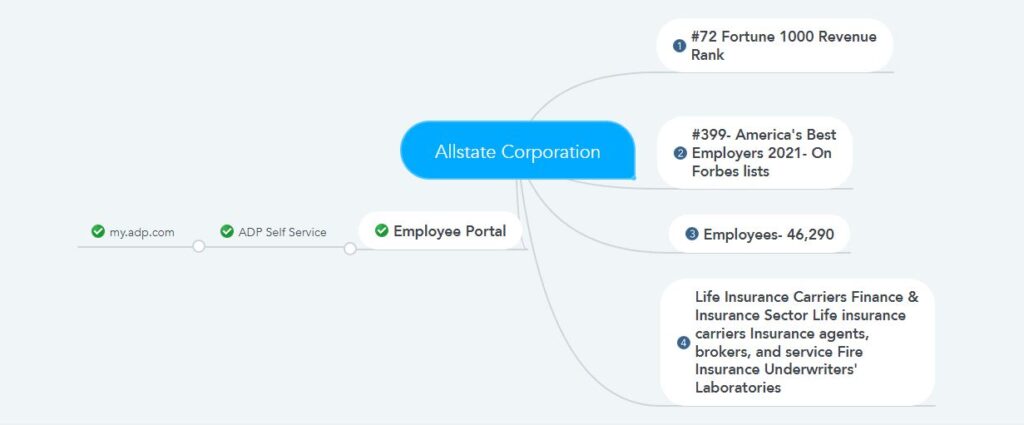

The Allstate Corporation is the country’s biggest publicly held personal lines insurance company. Allstate provides insurance items to around 16 million family units. Allstate was established in 1931 as a feature of Sears, Roebuck, and Co. Allstate became a publicly traded company in 1993. At that point, its first sale of stock was the biggest in U.S. history. On June 30, 1995, it became a completely independent business after Sears divested its remaining shares to Sears’s shareholders. However, if you are working in this company, your direct deposit information, pay stubs, w2s statement, and changes to your government and state income tax withholding (W-4) can be self-managed through the ADP web-based interface as well as the mobile solution app.

How to Use ADP Self Service

On the off opportunity that you are recently employed, first check your email. You should have gotten an auto-created email from ADP with a registration link. In case you really did not get the email, kindly attempt the choice approach listed below-

Pay Stubs & W2s via ADP Mobile:

In case you’re a worker of Allstate, access to pay statements and W2 statements effectively on the entirety of your cell phones utilizing the ADP Mobile app. Download and install the application on your Android device or iPhone and tap Sign In at the top-right of the Home display screen. When signed in, you can see your check information for compensation, just as allowances notwithstanding. Print a copy of your payment stub and w2 statement. The payment statement is a document of each check stub available in ADP. The history on top of the page is by year and check day. If you’ve never signed into the application, click on “Register Now” to begin the process. Users will be required to enter a registration passcode and personal information to verify the account they are attempting to access and validate their identity.

From a desktop computer or laptop:

Once you have clicked the link supplied to you in the email, the registration passcode will certainly be pre-filled in. If you did not receive the e-mail, please comply with the steps below to finish the registration procedure and retrieve your paystubs as well as w2 statements. If you have any inquiries, it would be ideal to contact your HR office at 800-340-0475.

- Visit the REFERENCE suggested ADP’s link. (see the REFERENCE)

- Login with username and also password. Or follow the following steps if this is for the first time.

- Click on “Register now.”

- Select “FIND ME” as well as also finish the areas that will certainly be asked as well as likewise select Continue. From the search results- select Allstate Corporation. In case you have a registration passcode, you may click on the “I HAVE A REGISTRATION CODE,” enter your information, finish the fields that will be asked, and select Continue as an alternate decision of the “FIND ME.”

- In this step, you’ve to finish the additional verification.

- You’re consistently connected with an email address and mobile number to receive account notifications.

- Set up your user ID and password for your account. User ID is a framework produced and keeps the ADP rules for password creation.

- In the end, click on Create Your Account to finish the enrollment and set up your ADP account.

Now to find your check stubs and W2s

Once you’ve signed into your account, you can access your personal, payroll, tax obligation, and other work-related information on the “Myself” menu.

To view your pay stub, log into ADP at the REFERENCE recommended web link, click on Pay Statement under Quick Links, or go to Myself> Pay > Pay Statements.

To view your w2 form, log into ADP at the REFERENCE recommended web link, click on W2 Statement under Quick Links, or go to myself> Pay > W2 Statements. You should consent to get an electronic copy of your tax statement rather than a paper copy.

Now to find your past W2 statement.

- Visit the REFERENCE suggested Tax Form Management’s link. (see the REFERENCE)

- Log in by entering:-Employer Code 11197

- Click on “Register Now” and also follow the prompts.

- Continue via the verification procedure. You will be prompted to choose a delivery method (e-mail, text, or telephone call) for a one-time passcode that finishes the verification process.

- You will be approached to make a customized User ID and password upon sufficient identification verification and login.

- Click the “Set me up to receive my tax forms online.”

- Check out the disclosure and mark the checkbox to acknowledge your understanding and acknowledgment of the online tax document conveyance terms.

- Click on the “Accept & Continue.”

- Select the proper e-mail address and mailing address- after that, select “Confirm & Submit.”

- After the info is validated, you will undoubtedly be presented with an invoice page validating your electronic tax form delivery consent.

REFERENCE

looking for my w-2 form for 2021