In our personal lives, we have more or less income. Some go to the office by train or bus, some in their car. Some are shopkeepers, and some are buyers. Some fall asleep and go to the office in the morning, and some start calculating whether employees are working correctly. And after this addition-subtraction, getting on the bus or train, bringing on own car, etc., at the end of the month, someone gets paid and goes home with a tired body to calculate the creditor’s money, internet bill, house rent, etc.

On the other hand, the other party calculates how much money he earned this month. One of the two types we saw was the employee, and the other was the owner. But there are also two more types in our society. One of them earns money by doing something on his own, such as a street food vendor, small shopkeeper, sidewalk trader, independent contractor, etc. The profession is independent of them. Holidays that are full of complexity are neither fun nor comfortable. Their independent job, no responsibility to the boss. This is very real in our economic cycle. One earns a salary. A man earns as a businessman by working. One earns as an independent professional. The last person makes by spending or investing money. These four types of income we see conventionally. Employees, self-employed or independent contractors, traders, profiteers, all these economic activities are being conducted in these four types of realities. Of these, 10.1 percent are self-employed or independent contractors in the United States, which is more than 15 million.

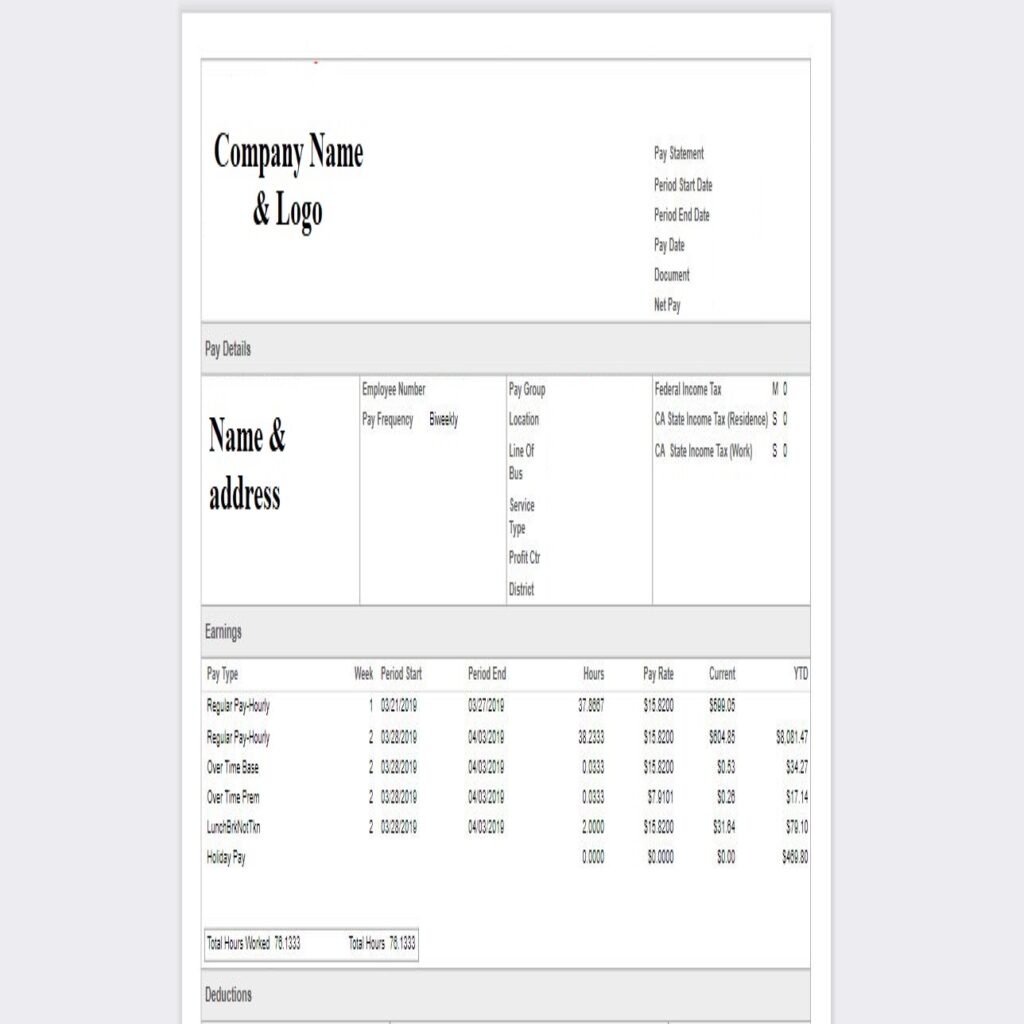

The point is that employees, big businesses, or recipients of dividends from the stock market do not have to face any problem with pay-stub as they get pay-stub from their organization. The problem is those who are self-employed, independent contractors, or small traders. Just as they need a pay-stub to get a loan, they also need a pay-stub for house rent; moreover, there is a need for a tax return at the end of the year. Do you know what laws the US government has to create a pay-stub yourself as a self-employed person or get a fake pay-stub created by a 3rd person?

Is there a pay-stub law for independent contractors or self-employed by the US government?

There are no special instructions for pay-stubs as there are particular forms for tax returns for independent contractors or self-employed. So there are no restrictions on how you can make a pay-stub or not. So if you need to create a pay-stub for yourself, you can follow the steps below.

1. Create your pay-stub with Microsoft Excel or Word. Or you can buy Pay-Stub templates available at various stores at low prices.

2. Free Pay-Stub Generator: There are many free pay-stub generator applications available online, but using these applications is very likely to expose your confidential information.

3. Paid Pay-Stub Generator: Various web sites of pay stub generators offer services at a nominal price or low price. Such as pay-slip.com. Only $29 for the whole year and $99 for the lifetime. On the other hand, you have to pay a service charge of $7 per month for one-time use only.

4. There are several payroll applications that you can verify and purchase.